-

COMPANIES

-

BENEFITS FOR COMPANIES

-

WHEN CAN A COMPANY USE INSTANT PAYMENTS?

Companies

Instant payments service users can be any type of companies which use Instant payments to initiate new payments and collect the countervalue of own invoices, including in relation with other businesses;

Benefits for companies

For businesses who implement”Instant payments” (traditional merchants, online shops, any other type of business) the main benefits are:

- Immediate collection of the money in the account (bank to bank transfers only takes a few seconds);

- Better management of the financial liquidity;

- Maximum availability – Instant payments is available 24 hours a day, 7 days a week, 365 days a year,

- Serious option to launch new loyalty/promotion programs of own services and products, based on the stimulation of their own customers to pay via Instant payments;

- Safety & Security – the operator of the Instant Payments is TRANSFOND, the institution responsible with conducting interbank electronic clearing and settlement in Romania since 2005;

- Decrease of expenses with other types of charges/payments.

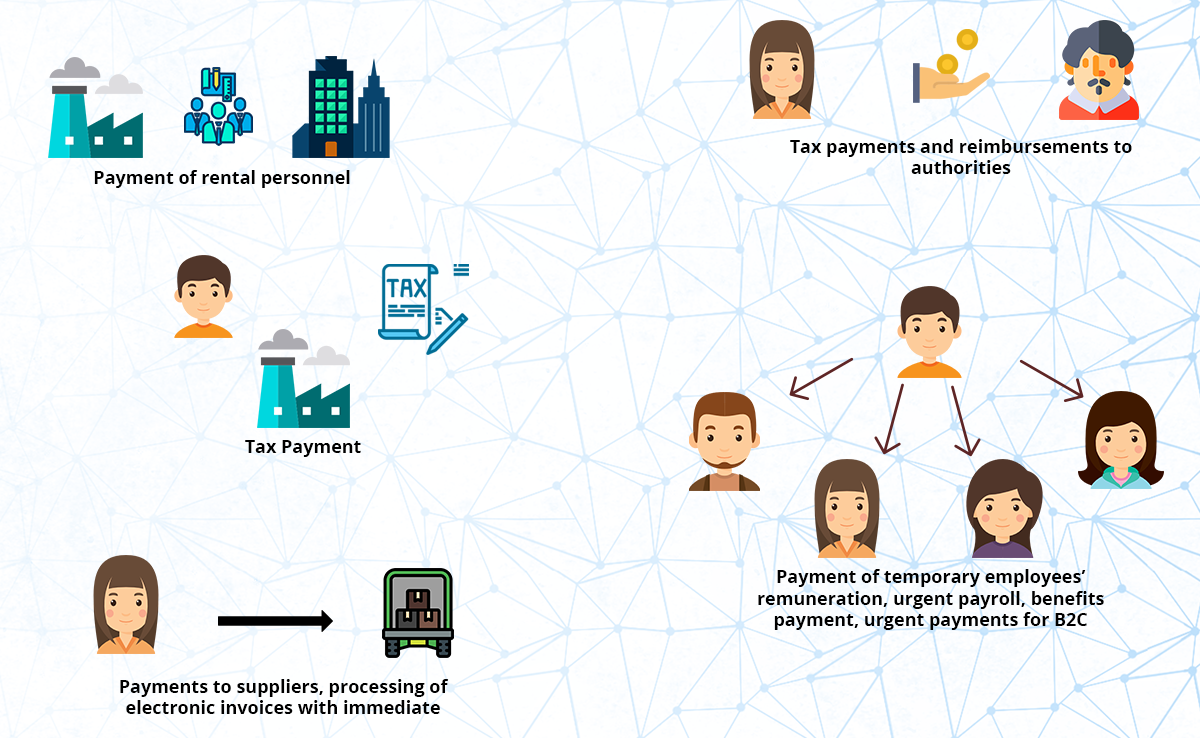

When can a company use Instant Payments?

- Urgent customers collection (individual customers and companies);

- Payments to suppliers, processing of electronic invoices with immediate payment etc.

- Payment of temporary employees’ remuneration, urgent payroll, benefits payment, urgent payments for B2C (i.e. disaster relief/aid) etc.

- Tax payments and reimbursements to authorities.

Companies

Instant payments service users can be any type of companies which use Instant payments to initiate new payments and collect the countervalue of own invoices, including in relation with other businesses;

Benefits for companies

For businesses who implement”Instant payments” (traditional merchants, online shops, any other type of business) the main benefits are:

- Immediate collection of the money in the account (bank to bank transfers only takes a few seconds);

- Better management of the financial liquidity;

- Maximum availability – Instant payments is available 24 hours a day, 7 days a week, 365 days a year,

- Serious option to launch new loyalty/promotion programs of own services and products, based on the stimulation of their own customers to pay via Instant payments;

- Safety & Security – the operator of the Instant Payments is TRANSFOND, the institution responsible with conducting interbank electronic clearing and settlement in Romania since 2005;

- Decrease of expenses with other types of charges/payments.

When can a company use Instant Payments?

- Urgent customers collection (individual customers and companies);

- Payments to suppliers, processing of electronic invoices with immediate payment etc.

- Payment of temporary employees’ remuneration, urgent payroll, benefits payment, urgent payments for B2C (i.e. disaster relief/aid) etc.

- Tax payments and reimbursements to authorities.